A Mutual Fund is a trust that pools the savings from investors who share a common financial goal. The money pooled from investors is invested by Fund Managers, appointed by the AMC, in capital market instruments such as shares, debentures and other securities, according to the investment objective of the scheme. The investment generates returns that are passed on to the unitholders of the scheme in proportion to the units held.

A mutual fund is set up in the form of a trust, which has a sponsor, trustees, an asset management company (AMC) and a custodian. The trust is established by one or more sponsors. Sponsor is like the promoter of a company. The trustees of the mutual fund hold its property for the benefit of the unitholders. The trustees are vested with the general power of superintendence and direction over AMC. They monitor the performance and compliance of SEBI Regulations by the mutual fund.

Asset Management Company (AMC), approved by SEBI, manages the funds by making investments in various types of securities. Custodian, who is registered with SEBI, holds the securities of various schemes of the fund in its custody.

Mutual funds offer benefits like:

Professional Management

AMC appoints qualified and experienced fund managers for each scheme who monitor the market and work towards generating optimum returns for unitholders in line with the objective of the scheme.

Diversification of Portfolio

According to the investment objective of the scheme, a mutual fund invests in a wide range of securities. It spreads the risks involved across various asset classes, even when the invested amount is small.

Allows small investments

Mutual funds allow investors to invest as low as Rs 5000/- and sometimes even lower. This makes it possible for small investors to invest in the capital market.

Convenience

Holding units of just one scheme allows the unitholder to diversify his money across a range of securities, without having to keep a track of individual investment in each security.

Flexibility

Mutual fund allows unitholders to switch between schemes and plans according to their requirements. However, please note that switching between schemes might involve costs.

Transparency

Mutual funds regularly share information about a unitholders investment value and portfolio of the scheme through personal communication and /or its website.

Schemes according to Maturity Period:

A mutual fund scheme can be classified into open-ended scheme or close-ended scheme depending on its maturity period.

Open-ended Fund/ Scheme

An open-ended fund or scheme is one that is available for subscription and repurchase on a continuous basis. These schemes do not have a fixed maturity period. Investors can conveniently buy and sell units at Net Asset Value (NAV) related prices which are declared on a daily basis. The key feature of open-end schemes is liquidity.

Close-ended Fund/ Scheme

A close-ended fund or scheme has a stipulated maturity period e.g. 5-7 years. The fund is open for subscription only during a specified period at the time of launch of the scheme. Investors can invest in the scheme at the time of the initial public issue and thereafter they can buy or sell the units of the scheme on the stock exchanges where the units are listed. In order to provide an exit route to the investors, some close-ended funds give an option of selling back the units to the mutual fund through periodic repurchase at NAV related prices. SEBI Regulations stipulate that at least one of the two exit routes is provided to the investor i.e. either repurchase facility or through listing on stock exchanges. These mutual funds schemes disclose NAV generally on weekly basis.

Schemes according to Investment Objective:

A scheme can also be classified as growth scheme, income scheme, or balanced scheme considering its investment objective. Such schemes may be open-ended or close-ended schemes as described earlier. Such schemes may be classified mainly as follows:

Growth / Equity Oriented Scheme

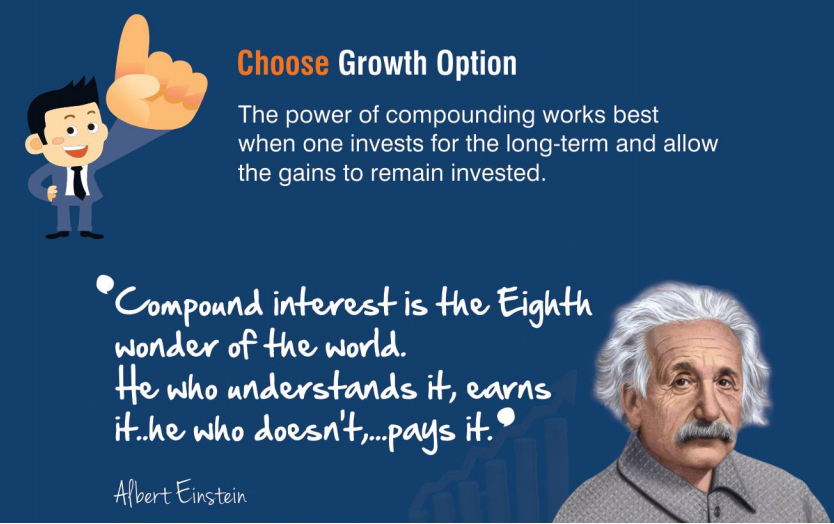

The aim of growth funds is to provide capital appreciation over the medium to long- term. Such schemes normally invest a major part of their corpus in equities. Such funds have comparatively high risks. These schemes provide different options to the investors like dividend option, capital appreciation, etc. and the investors may choose an option depending on their preferences. The investors must indicate the option in the application form. The mutual funds also allow the investors to change the options at a later date. Growth schemes are good for investors having a long-term outlook seeking appreciation over a period of time.

Income / Debt Oriented Scheme

The aim of income funds is to provide regular and steady income to investors. Such schemes generally invest in fixed income securities such as bonds, corporate debentures, Government securities and money market instruments. Such funds are less risky compared to equity schemes. These funds are not affected because of fluctuations in equity markets. However, opportunities of capital appreciation are also limited in such funds. The NAVs of such funds are affected because of change in interest rates in the country. If the interest rates fall, NAVs of such funds are likely to increase in the short run and vice versa. However, long term investors may not bother about these fluctuations.

Balanced Fund

The aim of balanced funds is to provide both growth and regular income as such schemes invest both in equities and fixed income securities in the proportion indicated in their offer documents. These are appropriate for investors looking for moderate growth. They generally invest 40-60% in equity and debt instruments. These funds are also affected because of fluctuations in share prices in the stock markets. However, NAVs of such funds are likely to be less volatile compared to pure equity funds.

Money Market or Liquid Fund

These funds are also income funds and their aim is to provide easy liquidity, preservation of capital and moderate income. These schemes invest exclusively in safer short-term instruments such as treasury bills, certificates of deposit, commercial paper and inter-bank call money, government securities, etc. Returns on these schemes fluctuate much less compared to other funds. These funds are appropriate for corporate and individual investors as a means to park their surplus funds for short periods.

Gilt Fund

These funds invest exclusively in government securities. Government securities have no default risk. NAVs of these schemes also fluctuate due to change in interest rates and other economic factors as is the case with income or debt oriented schemes.

Index Funds

Index Funds replicate the portfolio of a particular index such as the BSE Sensitive index, S&P NSE 50 index (Nifty), etc. These schemes invest in the securities in the same weightage comprising of an index. NAVs of such schemes would rise or fall in accordance with the rise or fall in the index, though not exactly by the same percentage due to some factors known as “tracking error” in technical terms. Necessary disclosures in this regard are made in the offer document of the mutual fund scheme.

There are also exchange traded index funds launched by the mutual funds which are traded on the stock exchanges.

These are the funds/schemes which invest in the securities of only those sectors or industries as specified in the offer documents. e.g. Pharmaceuticals, Software, Fast Moving Consumer Goods (FMCG), Petroleum stocks, etc. The returns in these funds are dependent on the performance of the respective sectors/industries. While these funds may give higher returns, they are more risky compared to diversified funds. Investors need to keep a watch on the performance of those sectors/industries and must exit at an appropriate time. They may also seek advice of an expert.

What is a Fund of Funds (FoF) scheme?

A scheme that invests primarily in other schemes of the same mutual fund or other mutual funds is known as a FoF scheme. An FoF scheme enables the investors to achieve greater diversification through one scheme. It spreads risks across a greater universe.

The NAV or the Net Asset Value is the total asset value per unit of the mutual fund after deducting all related and permissible expenses. The NAV is calculated at the end of every business day. It is the value at which the investor enters or exits the mutual fund.

A Systematic Investment Plan (SIP) is a vehicle offered by mutual funds to help investors save regularly. It is just like a recurring deposit with the post office or bank where you put in a small amount every month. The difference here is that the amount is invested in a mutual fund.

The minimum amount to be invested can be as low as Rs.100 and the frequency of investment is usually daily, weekly, fortnightly, monthly or quarterly. An SIP with an Equity fund allows you to participate the stock market without trying to second-guess its movements. Most investors think that buying stocks at low prices and selling them when prices are high is a favourable strategy. But this is hard to achieve and involves risky variables. A more successful investment strategy is to adopt the method called Rupee Cost Averaging. Under Rupee Cost Averaging, more units are purchased when prices are low and fewer units when prices are high.

The performances of Mutual funds are influenced by the performance of the securities market and economy. Performance of Equity Funds are linked to a large extent to performance of the stock market. The stock market in turn is influenced by the performance of the companies as well as the economy as a whole. The performance of the sector funds depends to a large extent on the companies within that sector. Bond-funds are influenced by interest rates and credit quality. As interest rates rise, bond prices fall, and vice versa. Similarly, bond funds with higher credit ratings are less influenced by changes in the economy.

KYC is a process to capture and validate customer details before a folio is created to begin transacting in mutual funds. The KYC process has been made uniform across the financial sector and is now done through KRAs (KYC Registration Agency). KYC is an acronym for “Know your Client”, a term commonly used for Client Identification Process. SEBI has prescribed certain requirements relating to KYC norms for Financial Institutions and Financial Intermediaries including Mutual Funds to ‘know’ their clients. This would be in the form of verification of identity and address, financial status, occupation and such other personal information. Applicant must be KYC compliant while investing with any SEBI registered Mutual Fund.

KYC is one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc), Investors need not undergo the same process again when they approach another intermediary.

DOWNLOAD KYC FORM

List of CAMS POS

An investor must mention clearly his name, address, number of units applied for and such other information as required in the application form. He must give his bank account number so as to avoid any fraudulent encashment of any cheque/draft issued by the mutual fund at a later date for the purpose of dividend or repurchase. Any changes in the address, bank account number, etc at a later date should be informed to the mutual fund immediately.

Mutual funds are required to despatch certificates or statements of accounts within six weeks from the date of closure of the initial subscription of the scheme. In case of close-ended schemes, the investors would get either a demat account statement or unit certificates as these are traded in the stock exchanges. In case of open-ended schemes, a statement of account is issued by the mutual fund within 30 days from the date of closure of initial public offer of the scheme. The procedure of repurchase is mentioned in the offer document.

Yes. The nomination can be made by individuals applying for / holding units on their own behalf singly or jointly. Non-individuals including society, trust, body corporate, partnership firm, Karta of Hindu Undivided Family, holder of Power of Attorney cannot nominate

The per unit price at which an investor buys units of the scheme. Depending on the Time-stamping of the investment (the time at which the transaction request is received) and the amount, NAV based prices are decided.

The per unit price at which a unit holder sells his units back to the mutual fund. The repurchase price is calculate as NAV less exit load.

Some Mutual Funds provides unitholders with an option to shift money into another scheme of the same fund house. For this option the fund may levy a switching fee.

Switching lets the unitholder channel his savings among the schemes in order to meet investment needs

Systematic Transfer Plan (STP) is a strategy where an investor transfers a fixed amount of money from one scheme to another, usually from debt funds to equity funds. Investing a lump sum amount in stocks or equity mutual fund could be risky for the investor as stock markets are volatile in nature and returns in equity mutual fund is linked to the performance of stock market. Systematic Transfer Plan helps to keep a balance of risk and return.

STP is ideal for investors who want to invest lump sum money in schemes with stable returns and ensure small exposure to equity schemes in order to avail of the potential for higher growth through equities.

Let’s understand STP with an example.

An investor gives instruction to transfer Rs 2000 from debt scheme to equity scheme every month. In January 2013, he holds 4000 units of equity scheme and 8000 units of debt scheme.

Let’s say in February, the NAV of the debt scheme is Rs 25.

Therefore, number of units required to be redeemed from debt scheme = 2000/25 = 80 units

After redeeming the unitholder will have 7920 units in the debt scheme.

Rs 2000 will be used to purchase additional units of the equity scheme. Let’s say the NAV of the equity scheme in February 2013 is 40.

Therefore number of units of the equity scheme to be purchased = 2000/40= 50 units

The unitholder will now hold 4050 units of the equity scheme.

A Systematic Withdrawal Plan (SWP) is a facility that allows an investor to withdraw money from an existing mutual fund at predetermined intervals. The money withdrawn from a systematic withdrawal plan can be reinvested in another portfolio or it can be used as a source of regular income.

Systematic withdrawal plans are ideal for investors who want to create a regular flow of income from their investments. Often, a Systematic Withdrawal Plan is used to fund expenses during retirement.

Understanding SWP with an example:

A unitholder buys 8000 units of a MF scheme in January 2013. He gives instructions for SWP of Rs 5000 at the end of every month.

Let’s say the NAV in February 2013 was Rs 40.

Therefore number of units required to redeem Rs 5000 = 5000/40 = 125 units

Then, at the end of February, the unitholder will have 8000-125 = 7875 units

Let’s say the NAV in March 2013 was Rs 50.

Therefore number of units required to redeem Rs 5000 = 5000/50 = 100 units

Then, at the end of February, the unitholder will have 7875-100 = 7775 units

Yes, Non-Resident Indians can also invest in mutual funds. Necessary details in this respect are given in the offer documents of the schemes

FATCA stands for the Foreign Account Tax Compliance Act, a U.S. tax initiative that requires all financial Institutes (including Indian Mutual Funds) to report financial transactions of US persons including entities in which U.S. persons hold a substantial ownership, etc. to the relevant tax authorities.

It is introduced by the United States Department of Treasury and the US Internal Revenue Service (IRS), the purpose of FATCA is to encourage better tax compliance by preventing US persons from using financial institutions outside US to avoid US taxation on their income and assets.

Disclaimer :

The section ‘Investor Education’ on this website is a platform for Mutual Fund customer to spread awareness and educate investors about various Mutual Fund products. It should not be construed as an offer to sell nor is a solicitation of an offer to buy units of any of the schemes of from MoneyGYAN.com. Figures indicated here are for illustrative purpose only and does not correspond to any live or historical data.